Updated on October 3, 2024 | 4 minute read | Olivia MacCunn

Home > Resources > Four really valuable things you can do with search data

Of course, market research is nothing new, but data insights will remain perennially significant. And needless to say, consumer habits have changed as a result of the pandemic, which experts suggest has accelerated ecommerce by an estimated six to ten years.

Yet many retailers tend to overlook the value of the data derived from their own ecommerce activities.

Search term data or keyword data is an incredibly valuable asset to those managing product listing ads (or PLAs) on search engines like Google and Bing. Relevant data extends to impression share and click share, the volume of search terms, and trends in cost per click for various products in various verticals.

Surveying consumers doesn’t always produce the most up-to-date or reliable information – can you be certain respondents answered truthfully? The pervasiveness of the internet in our day-to-day lives also means our habits are easily influenced, driving a capricious nature in purchasing trends. So search data can actually be more reliable than the results of surveying a limited number of people.

So, here are four really valuable things you can do with the search data at your fingertips:

It’s necessary to understand market size and product demand, for instance when seeking to enter a new market – particularly if it’s a new or niche market. In this case, it’s often difficult to get your hands on up-to-date information.

We recommend researching and collecting search terms related to specific product categories, to gain insight into the market demand, and how it fluctuates throughout the year. This includes analysing data for unexpected upticks in demand.

Access to your own search term data provides you insight into the popularity and demand of your product that no other market research can offer. Sales data is just the tip of the iceberg – analysing impression share and clicks informs retailers of growing demand for products outside of their usual seasonality.

For instance, many prioritise their marketing campaigns for ski related products in Q4. Using the actual demand for these products, we can see shoppers still search for ski clothing and equipment throughout Q1.

With this insight, you can make more informed decisions concerning holding inventory and extending your marketing schedules to achieve more sales over a longer period of time.

Whether you’re a recently established start-up or have already built out a number of teams, the wealth of data freely available to you can contribute to a number of projects, campaigns, and goals.

A simple analysis of the search results for keywords around your target product categories helps to determine your direct and indirect competition, any barriers to entry, and identifies any competitors you’re unaware of.

Additionally, your share of voice or share of content can be estimated by researching your share of search, or the share of the search page results your brand owns. This, together with analysis of the top blogs and influencers appearing for the same search terms, can direct your marketing needs in terms of planning for PR and advertising strategies.

Similarly, you can plan lucrative partnership opportunities if you find high-ranking, multi-brand retailers who are likely to stock and sell your products.

I’m sure you’ve been told over and over that these are “unprecedented” and “uncertain times”, and while we’re all pretty sick of hearing about the ‘p-word’, its usage grew 57,000% in 2020 according to the Oxford English Dictionary. Who would have predicted that in 2019?

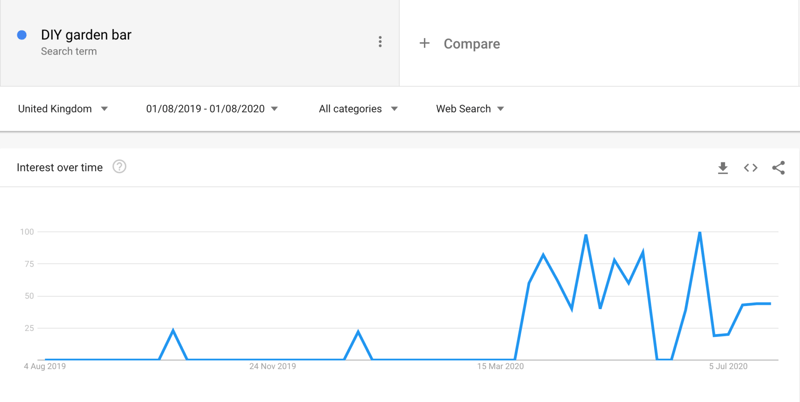

Likewise, no expert nor trend forecasting agency could have predicted 2020’s surge in traffic for at-home hobby kits or the mounting searches for making your own back garden bar.

It’s for this reason that we recommend keeping abreast of the wealth of data available from your search-based campaigns.

Google has retired Smart Shopping campaigns and has replaced them with Performance Max campaigns. Get up-to-date information on Performance Max here.

For ease of use and to save time, many retailers turn to Google’s automated tool, Smart Shopping. Despite the benefits of this free automation, Smart Shopping conceals important search term data and campaign performance: you only have access to general reporting.

This means you don’t know how Smart Shopping is spending your budget, using which channels (Shopping campaigns, display ads, Youtube ads, etc.), or what search queries are triggering your product campaigns. As such, Smart Shopping can be hugely detrimental to your digital approach, hindering your opportunity to reuse lucrative search term data in other marketing channels and platforms.

Read how Chilly’s Bottles broke through their ceiling after ditching Smart Shopping campaigns

For more information, read our full guide to Smart Shopping, or our side-by-side comparison of Smart Shopping and Bidnamic.

Why not book a demo with one of our Google Shopping specialists, and see we’d be a good fit to optimise your Google Shopping performance?